ANSWER If the ending inventory is overstated at the end of 2015 then cost of goods sold is understated. A trend of ending inventory balances that are increasing over time can indicate that some inventory is becoming obsolete since the amount should remain about the same as a proportion of sales.

Explain And Demonstrate The Impact Of Inventory Valuation Errors On The Income Statement And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Keep that in mind when you are ready to approach your boss.

. Overstatement of inventory would result into either overstatement of profit if it is closing inventory or understatement of profit if it is opening inventory. View the full answer. Personally that makes it better to understate rather than overstate inventory.

It also gives businesses a simplified method of computing the add-back so that these costs can be readily added to inventory when tax returns are prepared. For this reason inventory errors will always affect two accounting periods. We also use third-party cookies that help us analyze and understand how you use this website.

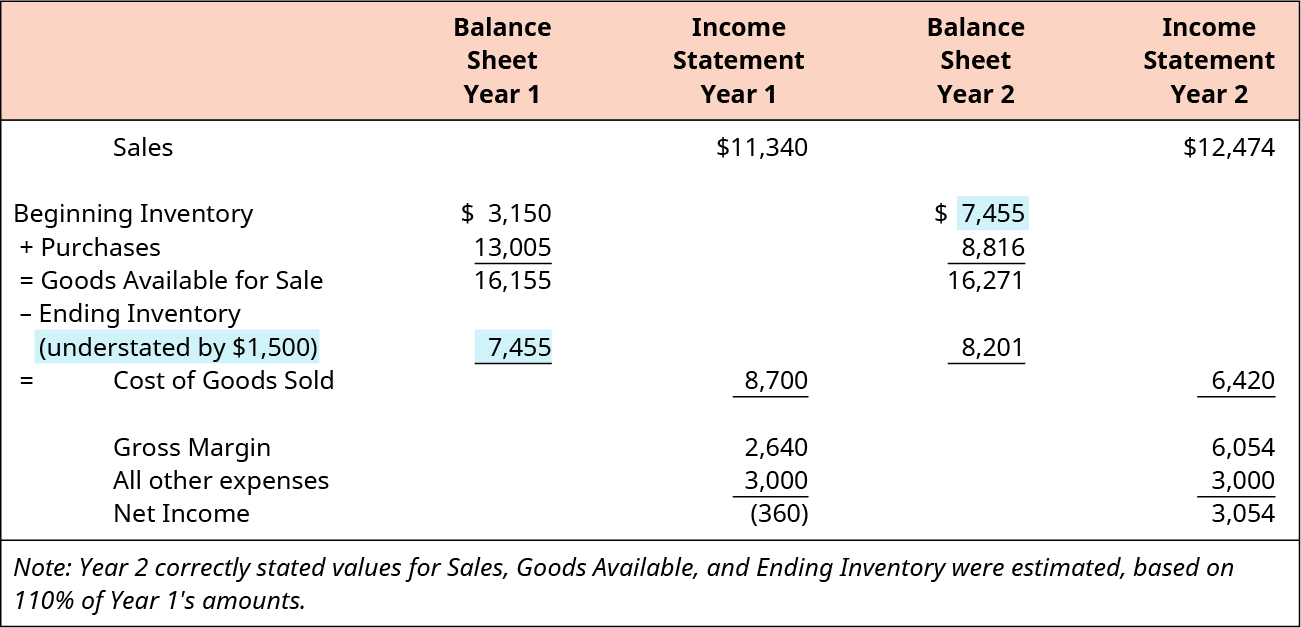

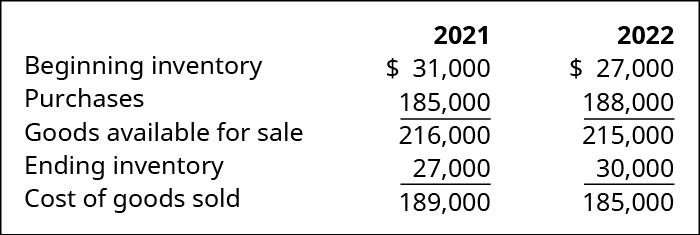

It can be seen from the tables above that the overstatement of the ending inventory of year 1 becomes an overstatement of the beginning inventory of year 2. Overstating ending inventory will reduce COGS which increases net income and increases retained earnings. COGS Beginning inventory Purchases - Ending Inventory.

An overstatement in ending inventory will cause. The retained earnings and other balance sheet amounts will be correct at the end of the second. Cost of goods sold in year 1 is understated.

However since there was an overstatement of ending inventory the ending inventory. In case of overstatement of closing inventory. Most likely Phar Mor used a periodic inventory method so that overstating ending inventory would reduce cost of goods sold and increase pretax profit.

Since the overstated amount of inventory at the end of one accounting period becomes the beginning inventory of the following period the following periods cost of goods sold will be too high and will result in the following periods gross profit and net income being too low. Conversely in understated inventory an adjustment entry needs to be made to remove the surplus stock which in turn reduces closing stock to the correct level and increases the COGS. Answer 1 of 2.

This means that either liabilities or stockholders equity must also be overstated to keep the balance sheet equation in balance. Understating ending inventory will have the opposite effect. As the last answerer said it will understate cost of goods sold and so inflate net income.

In year 1 ending inventory is overstated by 2000. Overstatements of ending inventory result. Write one disclosure note for the current period to describe the correction to the beginning inventory and beginning retained earnings balances.

The inventory turnover ratio measures the number of times you completely use up your stock on hand and must replace it with another. We review their content and use your feedback to keep the quality high. Profit and loss adjustment.

Cost of goods sold is equal to beginning inventory plus purchases minus ending inventory. Overstatements of beginning inventory result in overstated cost of goods sold and understated net income. To compute for cost of goods sold we deduct the ending inventory from the cost of goods available for sale which is the sum of the beginning inventory and purchases.

Out of these the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. An incorrect inventory balance causes an error in the calculation of cost of goods sold and therefore an error in the calculation of gross profit and net income. Conversely understatements of beginning inventory result in understated cost of goods sold and overstated net income.

Hilariously enough this will possibly increase your tax liability. Adjustment in both cases would be as follows. Write disclosure notes describing the nature and impact of the inventory error.

It has been our experience that if a. Inventory errors at the end of a reporting period affect both the income statement and the balance sheet. Therefore the 2015 net income is overstated by 5000.

Therefore if ending inventory at the end of 2018 was overstated then cost of goods sold for 2018 will be understated because we will have. If ABC Company has beginning inventory of 1000 purchases of 5000 and a correctly counted ending inventory of 2000 then its cost of goods sold is as follows. 6 level 2 deleted 4y.

7-29 Phar Mor overstated its assets by overstating inventories. In 2016 the opening inventory would be overstated and cost of goods sold would be overst. O Total stockholders equity is overstated in 2017 and correctly stated at the end of 2018.

Cost of beginning inventory cost of goods purchased cost of goods available - cost of ending inventory cost of goods sold. Explain the effect on cost of goods sold gross profit and net income in year 1 and year 2 Select all answers that apply. These cookies will be stored in your browser only with your consent.

The ending inventory of an accounting period will always become the beginning inventory of the following accounting period. 1000 Beginning inventory 5000 Purchases. Beginning inventory purchases - ending inventory Cost of goods sold.

Left unchanged the error has the opposite effect on cost of goods sold gross profit and net income in the following accounting period because the first accounting periods ending inventory is the. Not really a trick but just think of the basic formula. Assume that the cost of goods available for the year 2021 was 240000.

Conversely a decreasing trend in the ending inventory balance can indicate that a firms production capacity cannot keep up with customer demand levels. Gently confront the boss. O Total stockholders equity is overstated in 2017 and 2018 O Total stockholders equity is understated in 2017 and 2018.

Write a second disclosure note describing the changes to the prior-periods financial statements. This is code section 263A and it gives businesses specific guidance as to what overhead needs to be added to the code section 471 requirements. Answer 1 of 5.

Miscounting can occur through human error or. An adjustment entry for overstated inventory will add the omitted stock increasing the amount of closing stock and reduces the COGS. Approach your boss with a calm professional rational style Taylor says.

The formula for the cost of goods sold is. I can think of a few edge cases where this would result in a substantial loss of money. Example of Overstated Ending Inventory.

You can overstate inventory through miscounting and by applying the wrong costs to inventory on hand.

Explain And Demonstrate The Impact Of Inventory Valuation Errors On The Income Statement And Balance Sheet Principles Of Accounting Volume 1 Financial Accounting

Can Someone Please Explain Why Sales And Inventory Are Being Credited Here R Accounting

Solved The Manager Asks You To Assist Her With The Data Chegg Com

0 Comments